- #Under a perpetual inventory system update#

- #Under a perpetual inventory system manual#

- #Under a perpetual inventory system verification#

Differences could occur due to mismanagement, shrinkage, damage, or outdated merchandise.

#Under a perpetual inventory system manual#

A physical inventory count requires companies to do a manual “stock-check” of inventory to make sure what they have recorded on the books matches what they physically have in stock. Here, we’ll briefly discuss these additional closing entries and adjustments as they relate to the perpetual inventory system.Īt the end of the period, a perpetual inventory system will have the Merchandise Inventory account up-to-date the only thing left to do is to compare a physical count of inventory to what is on the books. You have already explored adjusting entries and the closing process in prior discussions, but merchandising activities require additional adjusting and closing entries to inventory, sales discounts, returns, and allowances. Figure 2.28 By: Rice University Source: Openstax CC BY SA 2.0 Adjusting and Closing Entries for a Perpetual Inventory System Figure 2.27 By: Rice University Source: Openstax CC BY SA 2.0Ī sales allowance and sales discount follow the same recording formats for either perpetual or periodic inventory systems. Under periodic inventory systems, only the sales return is recognized, but not the inventory condition entry. This means a decrease to COGS and an increase to Merchandise Inventory. When a sales return occurs, perpetual inventory systems require recognition of the inventory’s condition. Figure 2.26 By: Rice University Source: Openstax CC BY SA 2.0 The recognition of merchandise cost only occurs at the end of the period when adjustments are made and temporary accounts are closed. Under periodic inventory systems, this cost of sale entry does not exist. For the cost of sale, Merchandise Inventory and Cost of Goods Sold are updated. When a sale occurs under perpetual inventory systems, two entries are required: one to recognize the sale, and the other to recognize the cost of sale.

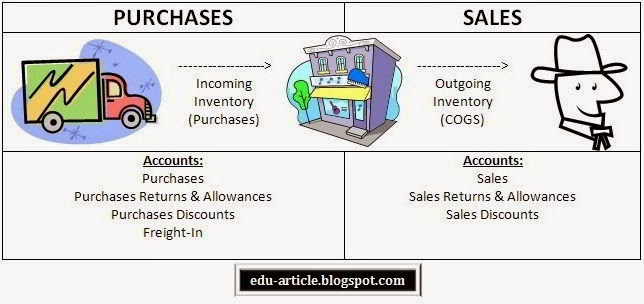

Figure 2.25 By: Rice University Source: Openstax CC BY SA 2.0 Under a periodic inventory system, Purchase Discounts (a temporary, contra account), increases for the discount amount and Merchandise Inventory remains unchanged. When a purchase discount is applied under a perpetual inventory system, Merchandise Inventory decreases for the discount amount. Figure 2.24 By: Rice University Source: Openstax CC BY SA 2.0

Purchase Returns and Allowances is a contra account and is used to reduce Purchases. Under periodic inventory systems, a temporary account, Purchase Returns and Allowances, is updated. Figure 2.23 By: Rice University Source: Openstax CC BY SA 2.0Ī purchase return or allowance under perpetual inventory systems updates Merchandise Inventory for any decreased cost. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method. The Merchandise Inventory account balance is reported on the balance sheet while the Purchases account is reported on the Income Statement when using the periodic inventory method.

#Under a perpetual inventory system verification#

This count and verification typically occur at the end of the annual accounting period, which is often on December 31 of the year. Under a periodic inventory system, Purchases will be updated, while Merchandise Inventory will remain unchanged until the company counts and verifies its inventory balance.

#Under a perpetual inventory system update#

When a company uses the perpetual inventory system and makes a purchase, they will automatically update the Merchandise Inventory account. There are some key differences between perpetual and periodic inventory systems. Under GAAP, once values are reduced they cannot be increased again. The main difference is that assets are valued at net realizable value and can be increased or decreased as values change.

Generally Accepted Accounting Principles (GAAP) do not state a required inventory system, but the periodic inventory system uses a Purchases account to meet the requirements for recognition under GAAP. There is a gap between the sale or purchase of inventory and when the inventory activity is recognized. The update and recognition could occur at the end of the month, quarter, and year. You can consider this “recording as you go.” The recognition of each sale or purchase happens immediately upon sale or purchase.Ī periodic inventory system updates and records the inventory account at certain, scheduled times at the end of an operating cycle. Characteristics of the Perpetual and Periodic Inventory SystemsĪ perpetual inventory system automatically updates and records the inventory account every time a sale, or purchase of inventory, occurs. Let’s look at the characteristics of these two systems. They can use a perpetual or periodic inventory system. There are two ways in which a company may account for their inventory.

0 kommentar(er)

0 kommentar(er)